Controversial Answer to China’s Health Insurance Needs

As more Chinese struggle to find an affordable insurance policy to cover out-of-pocket medical spending, some insurers have taken innovative approaches to address unmet needs, though sometimes in a controversial way.

A new type of health insurance policy offered by insurers led by star online insurer ZhongAn Online P & C Insurance Co. Ltd. has gained popularity among young Chinese consumers in recent years for its cheap premium charge but promise of high compensation.

Known as “the million yuan health insurance,” the policies often offer millions of yuan of compensation with premiums of several hundred yuan a year. Such policies, often sold online for easy purchase, are seen as an attractive option for people seeking commercial insurance to supplement the basic national medical coverage.

|

|

The emerge of the million yuan insurance plan injects some vitality into China’s tepid personal health insurance market, which has long consisted of expensive plans tailored for wealthy customers costing more than 100,000 yuan ($15,000) a year, and few alternative choices with limited coverage. Even with the pricey products, most insurers have suffered losses in their health insurance businesses.

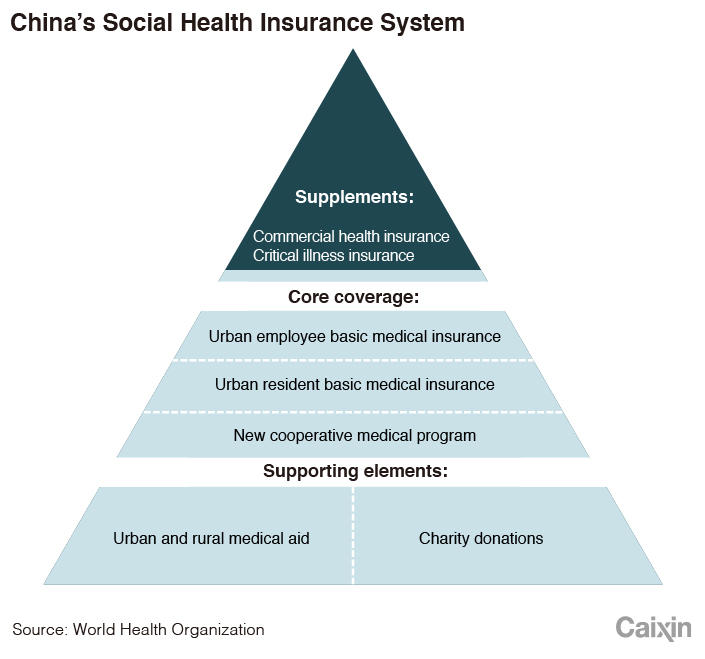

Most of China’s nearly 1.4 billion people are covered by the state-run basic medical insurance systems, which can provide 60% to 90% reimbursement for basic medical costs. But the state insurance programs mainly cover services in public hospitals and common diseases.

As the population ages and high medical costs threaten more families, calls have risen for insurers to offer more-affordable health insurance plans to supplement the state social safety network.

But Chinese insurers have long been cautious about moving into the health insurance market, mainly because of difficulties in making accurate estimates of policyholders’ potential medical costs due to inadequate actuarial capacity and a lack of price transparency in public hospitals.

Read more

China’s Health Insurance Dilemma

ZhongAn was the first to introduce the million yuan health insurance plan to the market, which quickly become a success and was copied by rivals.

The new type of health insurance policies mainly target young consumers so that insurers can keep claim rates low, industry analysts said. Meanwhile, the policies often set strict terms for claims and high deductibles of 10,000 yuan, meaning policy buyers won’t be covered for the first 10,000 yuan of medical costs. The policies usually cover only expenses for inpatient services.

Analysts said the average claim rate for the million yuan insurance plans is less than 30%, while administrative costs may account for 40% of premium income, enabling the policies to potentially generate attractive profits.

ZhongAn’s product was so popular and profitable that other insurers quickly followed, said one staff member at an insurance company. With more products available on the market, prices have been forced down, this person said.

But the restrictive terms have also drawn wide criticism. For instance, most insurers set complicated requirements on policyholders’ health records when processing compensation claims, which leads to a high rate of rejection and customer complaints. An industry insider said ZhongAn’s products have a claim rejection rate of as high as 20%.

Meanwhile, under most policies the insurer doesn’t guarantee an extension of the one-year coverage after expiration, a practice allowing insurers to control rising possibilities of compensation but exposing policyholders to the risk of lost protection if illness incurs, an analyst said.

But the restrictive terms are why insurers can hold down premiums to benefit more people, said Liu Pianpian, an executive at Swiss Reinsurance Co.’s China operation.

Challenges to obtain customers’ health records and make accurate estimates of potential medical costs have been the main obstacles hindering insurers in expanding their health insurance business. Instead, most health insurers prefer products such as simple critical-illness policies, which offer one-off compensation, and long-term investment-like products. Official data showed that in 2017, premium income from typical health insurance policies accounted for only 32% of the industry’s total income from health-related policies.

To encourage the health insurance business, the central government in 2017 initiated a pilot program to grant preferential taxes to insurers and customers of such policies. But the market has remained lukewarm.

Official data showed that by the end of 2018, only 319,000 health insurance policies were signed under the pilot program, generating total premium of 940 million yuan, in comparison of the total of 3.8 trillion yuan of insurance premium income that year.

Contact reporter Han Wei (weihan@caixin.com)

- 1Weekend Long Read: Can India Become the World’s Next Manufacturing Powerhouse?

- 2Chinese Localities Adopt ‘Sell Everything to Save the Day’ Policy to Ease Debt

- 3IBM Pulls R&D Units Out of China in Latest Withdrawal by U.S. Firm

- 4Cover Story: Chinese Brokerages’ Dual Roles in Bond Market Sparks Concern for Conflicts of Interest That Raises Systemic Risk

- 5Commentary: IBM’s Sudden China Layoffs Tarnish Reputation of ‘Foreign Company Culture’

- 1Power To The People: Pintec Serves A Booming Consumer Class

- 2Largest hotel group in Europe accepts UnionPay

- 3UnionPay mobile QuickPass debuts in Hong Kong

- 4UnionPay International launches premium catering privilege U Dining Collection

- 5UnionPay International’s U Plan has covered over 1600 stores overseas