In Depth: China’s Climate Goals Leave One Province Torn Between Past and Future

The scenic southwestern Chinese province of Yunnan is known for its tourism and rich resources for hydropower. Over the past few years, it has donned a new name — the aluminum valley of China — thanks to the massive relocation of electrolytic aluminum producers attracted by the region’s low electricity prices from all that hydropower.

The transition has turned out to be faster than the province was ready for. In mid-September, the provincial government announced that local smelters must cut aluminum production by 30% for the rest of 2021.

It’s part of the policy responses to an unusual power shortage that happened in May in the province. The shortage was due in part to the surge in industrial electricity consumption. The squeeze was also felt by the more developed, southern coastal province of Guangdong, which also experienced surging power demands and relies heavily on Yunnan for electricity.

Yunnan’s attempt to balance its traditional role as electricity supplier with more aspirational positioning as an industrial base illustrates that provinces, though all enthusiastic about China’s massive decarbonization campaign, have their own agenda. It’s a sign that China’s decarbonization campaign needs more comprehensive planning and coordinated actions.

Power shortage

In May 2021, Yunnan province was caught in a surprise power shortage, despite being a large producer of hydroelectricity.

|

Water flows out of the Baihetan dam on Sept. 3 during a flood discharge trial. Photo: VCG |

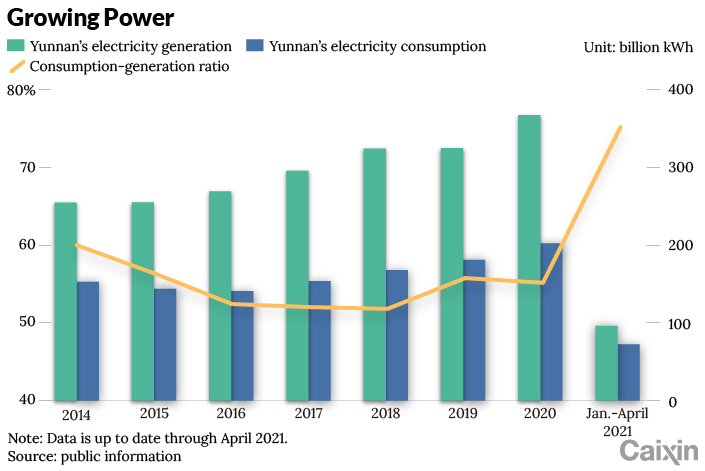

Part of the reason was that Yunnan has suffered a more severe dry spell than in previous years. Yunnan’s energy mix is heavily dependent on the weather. Hydropower accounts for more than 70% of its total installed generation capacity, and the province relies on other power sources such as coal to supplement its energy mix during the dry season, which usually lasts from November to May each year.

Coal power accounts for about 15% of the province’s installed capacity, but the high price of coal in April and May this year, the low coal inventories at Yunnan’s coal power plants, and the plunge in hydropower output, have exacerbated the electricity shortage.

It was a shortage that was quickly felt across the downstream industrial chain.

Yunnan then implemented electricity controls for major power consuming companies in the province. Electrolytic aluminum producers bore the brunt. According to AZ China Ltd., an energy information platform, Yunnan’s production capacity for electrolytic aluminum stands at nearly 4 million tons. A total of nearly 1 million tons of capacity was shut down in May, amounting to an average reduction in the electricity supply of 25%.

China’s ‘aluminum valley’

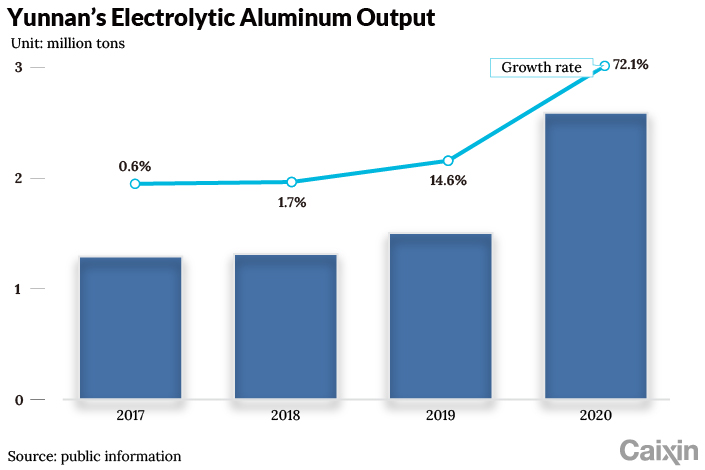

Yunnan has made great strides in increasing its electrolytic aluminum capacity in recent years. In 2020, the province added about 2.6 million tons of electrolytic aluminum production, a year-on-year jump of 72%. That obviously led to a jump in power usage —electricity consumption for the nonferrous metal smelting and processing industry in the province increased 38% from the previous year, accounting for a quarter of the province’s total.

And more capacity is expected to come online this year. In 2021, about 1.4 million tons of electrolytic aluminum capacity will be put into operation in Yunnan; in the first four months, Yunnan’s nonferrous metal smelting and rolling processing industry consumed 62.9% more electricity than the previous year.

|

Yunnan immediately felt the tension between the available power supply and rapid rise in demand. The provincial government, however, insisted on its “Aluminum Valley” plan.

The Yunnan Daily reported on May 30 that the province was promoting the implementation of new projects in 2021, including the second batch of 2 million tons of electrolytic aluminum capacity from Weiqiao Pioneering Group, the largest private aluminum company in China, and the interprovincial transfer and capacity replacement of 138,000 tons of electrolytic aluminum capacity of Aluminum Corp. of China, the largest state-owned aluminum enterprise in the country. When these projects are finished, the province will have about 8.46 million tons of aluminum production capacity, the highest of any province in the country.

Clean and more environmentally friendly, “hydroelectric aluminum” is in fashion in the aluminum industry. For the Yunnan provincial government, increased electrolytic aluminum capacity can help the province upgrade its industries and shift from selling electricity to selling a product — in this case, aluminum.

|

A worker loads aluminum. Photo: VCG |

Yunnan province’s primary policy for attracting electrolytic aluminum enterprises is its compelling preferential electricity price — 0.25 yuan (3.9 U.S. cents) per kilowatt-hour (kWh), a price that is 16% to 22% lower than the average in the industry.

That’s an attractive offer, since the cost of electricity accounts for 40% to 50% of an electrolytic aluminum enterprise’s costs.

In January 2020, to fulfill the promise of an ultra-low electricity price of 0.25 yuan per kWh, the Yunnan government set up a new company called Yunnan Electric Power Distribution and Trade Co. Ltd. The new company’s purpose is to “intercept” a portion of the profits from the sale of electricity on the west-to-east power transmission project, which it then uses to subsidize electricity prices paid by newly commissioned electrolytic aluminum enterprises. The company is a wholly state-owned enterprise under the provincial government, with the province’s economic planning agency and energy administration each holding 50% of the company’s shares.

Yunnan is attractive to electrolytic aluminum companies. For one thing, using hydroelectric aluminum is in line with China’s decarbonization policies and it makes their business development plans more sustainable. For another, Yunnan’s electricity price concessions are significant, but seats are limited as the province’s hydropower resources aren’t endless. That creates a ceiling for production capacity. Companies want to come early, before the door closes.

However, an insider of the China Non-Ferrous Metals Industry Association pointed out that Yunnan province also needs to moderate the pace of electrolytic aluminum enterprises’ production, as a sudden jump of excess production could be accompanied by hidden dangers. “This year, Yunnan has been taught a lesson, and in 2022 it should learn from its mistakes,” the insider said.

|

Weather has had a huge impact on Yunnan’s (power supply), but the province has more and more enterprises with continuous production, thus having continuous demand for electricity. “How can Yunnan ensure its supply of power when the dry season comes? This is really a problem that deserves to be thought about and solved by the entire industry,” said Zhang Meng, an AZ China analyst.

“Electrolytic aluminum production is characterized by a large load, long-term stability, and the need for the basic load of electricity. The development of electrolytic aluminum with the amount of abandoned hydropower itself is not in line with the characteristics of the industry. We have to use thermal power in the dry season,” said a source from China Nonferrous Metals Industry Association.

Hungry Guangdong

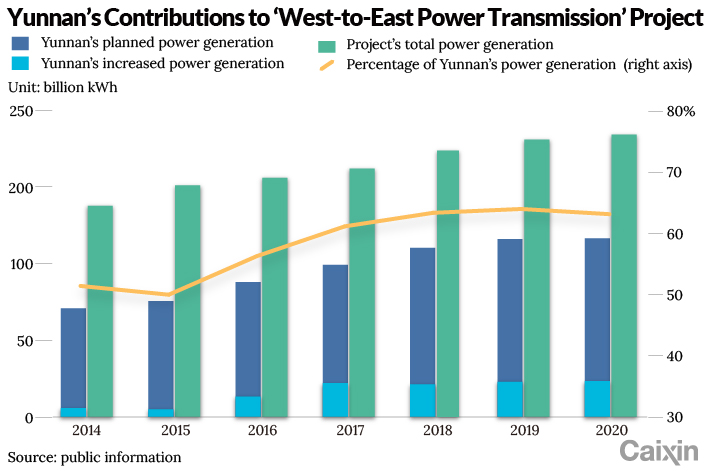

Yunnan is a critical part of one of China’s big power infrastructure projects which was designed to ease the country’s imbalance of energy.

The west-to-east electricity transfer project was initiated during the 10th Five-Year Plan for the years 2000 to 2005. The goal was to bring investment and development to China’s economically lagging West while providing power to the electricity-hungry eastern provinces.

Yunnan and Guangdong are respectively the largest transmitter and largest receiver of electricity supplied by the project. Yunnan’s sudden shortage of power was felt immediately in Guangdong.

If China is the world’s factory, then Guangdong is China’s factory. It is home to one of the largest manufacturing industries in the country. In the first five months of 2021, China’s manufacturing sector was strong, operating at full capacity when other manufacturing countries were still struggling with Covid-19. The high industrial electricity consumption was coupled by equally high demand from residents, due to the province’s warm weather. In May, electricity consumption remained high, while there were widespread power cuts and restrictions in Guangdong.

|

During the 13th Five-Year Plan period (2016-2020), 45% of electricity generated in Yunnan was transferred to Guangdong through the west-to-east power transmission project, which accounted for about one-third of Guangdong’s power consumption at the time. At present, the two provinces are engaged in a protracted negotiation over the 14th Five-Year Plan framework agreement for the project.

The contest between Yunnan and Guangdong over clean electricity reflects the new situation now that China has targets for peaking its carbon emissions and achieving carbon neutrality. Different provinces now have different agendas. Yunnan, as a resource-rich province, wants to reduce cross-provincial power transfers to boost its own industrial base, while Guangdong province doesn’t have enough clean energy to offset the reduced transmission from Yunnan.

“Yunnan wants to retain hydropower to develop its own industry, and clean electricity is good for the nation’s ambitious goals to ‘peak carbon dioxide emissions in 2030 and achieve carbon neutrality in 2060,’ known as the 30-60 plan, as well as product exports,” an industrial analyst explained.

A number of industry insiders said that, based on the current situation, Yunnan will continue to experience tension in its power supply, and the contradiction between industrial transfer and cross-region power transmission will become more and more pronounced.

In the long run, the industrial transfer will continue during the 14th and 15th Five-Year Plan periods, and there is a lot of uncertainty about the balance of electricity consumption in Yunnan, Guizhou and other clean-energy-rich provinces. The most feasible way is to establish a regional electricity market, break the barriers between provinces, and take better advantage of the market ability to allocate resources efficiently, said Feng Yongsheng, an associate researcher at the National Academy of Economic Strategy under the Chinese Academy of Social Sciences.

A senior electricity expert supports energy production centers such as Yunnan in developing their own industrial sectors. In his opinion, capital has “voted with its feet” as a large number of enterprises are moving closer to energy sources. As the economy in western China is taking off and a wave of load shifting is already taking place, it is time for the west-to-east power transmission project to be adjusted accordingly. As the eastern provinces lack local resources, low-end manufacturing should be reduced.

Meanwhile, in promoting investment in electrolytic aluminum projects, Yunnan also promised to greatly expand its capacity for solar and wind power. Caixin has learned that the province plans to build 3 gigawatts (GW) of new solar power generation capacity and 8 GW of wind power capacity starting this year. However, solar and wind power both share a drawback with hydropower in that all three are intermittent sources of power, while electrolytic aluminum production requires an uninterruptible supply of electricity.

It appears that Yunnan will need to develop some sort of energy storage to keep the power flowing during the dry season. As a leader of Huaneng Lancang River Hydropower Inc. put it: “The road is clear: we should develop new energy, use hydropower and energy storage to regulate peaks, and we must improve energy storage in a big way.”

Zhao Xuan contributed to this story.

Contact editor Michael Bellart (michaelbellart@caixin.com)

Download our app to receive breaking news alerts and read the news on the go.

Get our weekly free Must-Read newsletter.

- PODCAST

- MOST POPULAR