In Depth: Saving Peking University’s Fallen Tech Conglomerate

Peking University Founder Group Corp. (PUFG) was once the poster child for the entrepreneurial spirit that flowed from the hallowed halls of China’s elite universities in the 1980s as reform and opening-up fever gripped the country. Today, it’s become yet another example of a debt-ridden sprawling conglomerate undergoing a court-mandated bankruptcy reorganization after years of reckless expansion built on unsustainable debt, with some corruption thrown in for good measure.

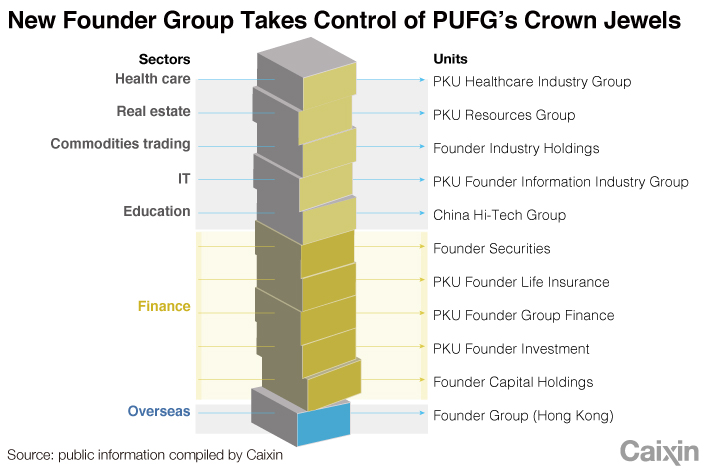

Many of the other high-profile busted corporate flushes that have been through the bankruptcy restructuring or liquidation mill were victims of massive corruption or asset stripping by their previous owners, or weak players in their sectors or in industries with poor prospects. But PUFG has a portfolio of attractive assets in growth areas, including medical and healthcare operations, a securities brokerage, an insurance business that comes with a coveted insurance license, microelectronics, and real estate.

Its future now lies in the hands of its creditors, who will need to agree to take significant losses, and a consortium led by the life insurance arm of Ping An Insurance (Group) Co. of China Ltd. (601318.SH), one of the country’s top financial conglomerates, which in January was announced the winner of an auction for PUFG’s assets. Under the terms of the deal, the consortium will pay up to 72.5 billion yuan ($11.3 billion) to take over the viable parts of PUFG’s empire which will be injected into a new company, New Founder Group (NFG).

|

From modest beginnings as a platform to sell a Chinese-character laser phototypesetting system invented by Wang Xuan, a professor at the prestigious Peking University, PUFG became a vehicle to commercialize other technologies such as a color desktop publishing system and a computer management system for gathering and editing news. But as the 21st century dawned, its ambitions moved well beyond the confines of academia and niche technology and after Wang’s death in 2006, the company started to transform itself into a diversified investment holding group.

Today its activities span healthcare, insurance, microelectronics, semiconductors, stock broking, commodities trading and real estate, and six of its subsidiaries and affiliates are listed on the stock exchanges of Shanghai, Shenzhen, and Hong Kong. But that expansion came at a cost — by the end of 2018, PUFG’s total liabilities had soared to 295.1 billion yuan, with 106 billion yuan of that added since the end of 2017, according to a report (link in Chinese) by Huachuang Securities Co. Ltd. based on data compiled by Wind Information Co. Ltd. Its interest-bearing debt stood at 168.1 billion yuan, triple the total in 2014. The group as a whole was also struggling operationally, reporting a net loss of 2.5 billion yuan in the first three quarters of 2019

The dominos began to fall in December 2019 when PUFG failed to repay a 270-day, 2 billion yuan bond. On Feb. 14, 2020, Bank of Beijing Co. Ltd., one of its creditors, applied (link in Chinese) to a court to force PUFG into a restructuring under the bankruptcy law, and approval came five days later.

In total, PUFG has defaulted on $3 billion of dollar bonds and 34.5 billion yuan of onshore bonds, according to data compiled by Bloomberg. The company is technically insolvent, with its total liabilities exceeding its total assets by 84.7 billion yuan as of Jan. 31, 2020, according to a report by accountancy firm Ernst & Young.

Read More

Exclusive: Founder Warns of ‘Extremely Tight’ Liquidity After Bond Default

The court appointed an administrator to manage the restructuring — a group led by the People’s Bank of China, the Ministry of Education, relevant financial regulatory agencies, and officials from various departments of the Beijing city government, although sources with knowledge of the matter told Caixin that executives from China Cinda Asset Management Co. Ltd., one of the “Big Four” state-owned asset management companies, are also heavily involved. The group has been working to put together a detailed restructuring proposal that has involved finding buyers for the viable parts of the conglomerate and working out just how much money creditors — who to date have submitted claims amounting to 256.2 billion yuan — will be able to recover.

After months of tense negotiations with bidders, the administrators whittled the contenders down to two consortia — one led by Taikang Life Insurance Co. Ltd., one of the country’s top 10 life insurers by premium income, and the other helmed by its bigger rival Ping An Life Insurance Co. of China Ltd. Both had their eye on the jewel in PUFG’s crown: its healthcare and medical assets.

Ping An was a relative latecomer to the scene, and only formally came on board in August 2020 when it teamed up with another Shenzhen-based company, Amer International Group Ltd., which subsequently dropped out, and Zhuhai Huafa Group Co. Ltd., owned by the city government of Zhuhai in southern Guangdong province, which had already expressed interest. Taikang Life’s main partner was a group of state-owned enterprises from the city of Wuhan in central China.

Both insurance giants were keen to get their hands on PKU Healthcare Industry Group Co. Ltd., which owns the flagship Peking University International Hospital and more than 10 healthcare institutions, and PKU HealthCare Corp. Ltd. (000788.SZ), a Shenzhen-listed company involved in research and development and manufacturing of pharmaceuticals. In the final round of bidding in December 2020, Ping An won out as its offer was far higher than its rival, sources with knowledge of the matter told Caixin, and the administrator’s decision was formally announced (link in Chinese) on Jan. 29.

Working out the details of the deal, separating the assets and debts to be included in the new company, NFG, and agreeing the fine print were complicated, and the bankruptcy administrator applied to the court on Jan. 11 for a three-month extension to its Jan. 31 deadline for submitting a draft restructuring plan. The negotiations with Ping An went down to the wire and the draft restructuring agreement (link in Chinese) was signed on April 30, the last day of the extension.

One of the reasons for the delay was related to the use of the brand names related to Peking University, such as PKU Healthcare and Peking University International Hospital. Under the terms of the restructuring, Peking University will cease to have any links with NFG, casting doubt over Ping An’s ability to continue using the names for the healthcare and medical businesses it was buying, sources with knowledge of the matter told Caixin. Finally, Ping An signed a brand licensing agreement with the university allowing it to continue to use the names, they said.

|

Under the terms of the deal, PUFG’s “good” assets, namely healthcare, finance, information technology, education, commerce and trade, and real estate, will be injected into NFG. The semiconductor assets, comprising Founder Microelectronics International Co. Ltd., will be excluded from the new company and will be sold for 800 million yuan to Shenzhen Shenchao Technology Investment Co. Ltd., a company controlled by the Shenzhen government.

The remaining “bad” assets will be kept in the old PUFG and disposed of or written off. These comprise equity assets which have defective titles, meaning they cannot be sold or transferred and have no actual operating value, or where litigation is pending over disputed ownership. They also include unrecoverable accounts receivable that date back several years.

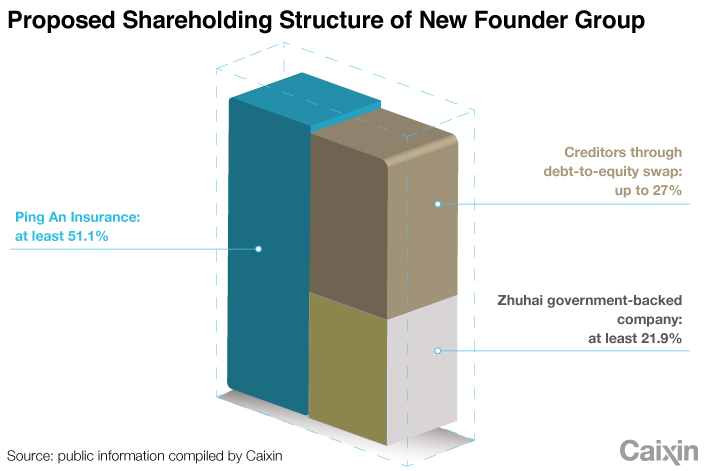

Ping An Life and Zhuhai Huafa will between them pay 52.9 billion yuan to 72.5 billion yuan for 73% to 100% of NFG, depending on which of the three proposed repayment options creditors choose to accept, according to a filing Ping An made to the Hong Kong bourse on April 30. Ping An Life will buy a controlling interest in NFG of between 51.1% and 70%, at a cost of 37.1 billion yuan to 50.8 billion yuan.

Zhuhai Huafa and two other companies owned by the Zhuhai government will set up a limited partnership to buy a stake of up to 30% for up to 21.8 billion yuan, comprising 8.7 billion yuan from internal resources and 13 billion yuan funded through a loan from Ping An, sources close to the matter told Caixin.

Although Ping An started out as an insurance company, it has built up a significant healthcare business, especially online services. Participation in the PUFG restructuring is an important move for the company to “further boost its strategic layout in the healthcare sector and actively build a healthcare ecosystem,” Ping An said in its April 30 filing.

The online medical app, Ping An Health, operated by Ping An Healthcare and Technology Co. Ltd., is the biggest of its kind in China with more than 370 million registered users. The app, formerly known as Ping An Good Doctor, offers services such as helping patients get online medical consultations and making offline appointments.

Ping An Health has been building its offline partner networks and in-house medical team. At the end of 2020, it had 2,247 of its own medical staff, an increase of nearly 60% from 2019. Ping An plans to integrate its online and offline medical resources to increase hospital traffic and revenue, and offer more financial products including insurance policies through its healthcare services, a company executive said on a recent conference call to discuss the restructuring.

But some analysts have raised concerns over the potential impact of the acquisition on Ping An’s finances and its strategy. In a report (link in Chinese) issued May 4, analysts at Zhongtai Securities Co. Ltd. (600918.SH) said that whether Ping An’s bid is reasonable depends on the extent to which the integration of PUFG’s healthcare resources can boost the group’s life insurance sales and lower operating costs of hospitals. Xia Changsheng, an analyst at Tianfeng Securities Co. Ltd. (601162.SH), warned (link in Chinese) not only of the potential risks to the successful integration of the acquired businesses but also of the time it would take for Ping An to see the benefits to its insurance business.

Over the years, Ping An has also expanded into banking and securities and plans to retain some of PUFG’s financial assets. Shanghai-listed brokerage, Founder Securities Co. Ltd. (601901.SH), is of particular interest to the company, sources with knowledge of the matter have told Caixin. The plan is to merge the firm with its own broking operation, Ping An Securities Co. Ltd., to create a much larger player that could break into the top league of Chinese brokers, a source close to the deal said.

Ping An Securities ranked 18th among Chinese brokers in 2019 by net assets while Founder Securities was 14th, according to data (link in Chinese) compiled by the Securities Association of China. Combining the two would boost its position to 9th in terms of net assets, and 8th in terms of revenue.

NFG’s two other major financial assets, PKU Founder Life Insurance Co. Ltd. and PKU Founder Group Finance Co. Ltd., are of less interest to Ping An, industry insiders said. Its own insurance operations are much larger and more profitable and it has no need of Founder’s sought-after life insurance license, analysts at Huachuang Securities wrote in a recent report (link in Chinese).

Three investors have already expressed interest in buying Founder Life, which could raise more than 10 billion yuan for Ping An, sources close to the restructuring told Caixin. Founder Group Finance, which provides financial services to PUFG and its units, has been valued at around 5 billion yuan and will also be put up for sale, sources close to the matter said.

Other assets likely to be put on the block include Founder Technology Group Corp. (600601.SH), which will seek strategic investors as part of a restructuring later this year, and Hong Kong-listed property developer Peking University Resources (Holdings) Co. Ltd., which has reported losses for two consecutive years, sources with knowledge of Ping An’s plans told Caixin.

Zhuhai Huafa’s interest in NFG lies not in ownership of the operating assets, but in their location. The Zhuhai State-owned Assets Supervision and Administration Commission, which owns Huafa, is planning to move the registration of NFG and its core businesses to the city’s Hengqin New Area which is part of the Guangdong Pilot Free Trade Zone, sources close to the matter told Caixin. That’s already aroused concern in Hunan province, where Founder Securities is currently registered, sources close to the deal said.

But this is not a done deal yet. The restructuring proposal needs to be agreed by PUFG’s creditors, who are being forced to take a substantial hit to their pockets. They will meet on Friday (link in Chinese) to vote on the plan which will be approved if more than half the creditors whose claims account for more than two-thirds of the debt agree.

As of April 20, a total of 743 creditors had reported to the bankruptcy administrator that they were owed a combined 256.2 billion yuan by PUFG, its three subsidiaries and one affiliate (Peking University Resources Group Co. Ltd.), according to the draft restructuring plan obtained by Caixin. That’s a substantial increase on last August, when PUFG said (link in Chinese) that 478 creditors had submitted claims for a combined 187.9 billion yuan.

Of the 130.9 billion yuan of debt verified by a previous creditors’ meeting and the court, 88.7% is made up of unsecured debt which the restructuring plan is proposing to repay in cash, through shares in NFG offered via a debt-to-equity swap, and a postponement of repayment of some debt.

Creditors will be paid in full in cash for the first 1 million yuan of debt and for every 100 yuan of debt exceeding that figure they will get a choice. Option one is to receive about 20.3 yuan in cash and 1.1 shares in NFG, which can be repurchased by the company eight years after the plan is approved. For those who don’t want shares in the new company, option two will involve a cash payment of 31.4 yuan and option three will involve a cash payment of 20.3 yuan with a further 12.9 yuan held as debt which will be repaid under a fixed timetable.

The restructuring plan takes a relatively optimistic view of the new company’s prospects. Under its assumptions, the new shares will have a median value of 37.3 yuan within five years, which would allow creditors to recover up to 61% of their investment through the debt-to-equity swap plan. But some creditors doubt 61% is achievable and it’s unlikely many market-oriented financial institutions will be prepared to wait around for eight years given the uncertainties surrounding the company’s future.

Creditors who decide on option two will recover around 31% of their money immediately. Those choosing option three will be paid interest on the debt at a rate of 2.3% annually for eight years and will have the principal repaid in stages over the final three years, giving them a recovery rate of 33%.

All eyes now will be on the outcome of the creditors’ meeting and whether the terms of the deal on offer are good enough to secure the support of the majority. PUFG is not out of the woods yet, but an agreement over the debt workout will mark a key step forward in efforts to secure the future of its crown jewels.

Cui Xiankang contributed to this report.

Contact reporter Luo Meihan (meihanluo@caixin.com) and editor Nerys Avery (nerysavery@caixin.com)

Download our app to receive breaking news alerts and read the news on the go.

Get our weekly free Must-Read newsletter.

- PODCAST

- MOST POPULAR