Analysis: How to Keep Foreign Capital Flowing Into Chinese Stocks

Listen to the full version

In the wake of the flood of foreign capital that poured into the Chinese mainland stock market earlier this year, analysts have started to wonder what it will take to keep investor confidence stoked.

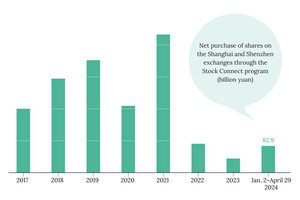

Net overseas investment in the market via the Stock Connect program — which allows offshore investors to trade mainland stocks through Hong Kong’s stock exchange and vice versa — reached 83 billion yuan ($11.7 billion) in the first five months of this year, according to Caixin calculations based on exchange data. The figure is nearly double last year’s total, although it pales in comparison with that of 2021.

Download our app to receive breaking news alerts and read the news on the go.

Get our weekly free Must-Read newsletter.

- DIGEST HUB

- Net overseas investment in the Chinese stock market via the Stock Connect program reached 83 billion yuan ($11.7 billion) in early 2023.

- The surge was driven by better-than-expected earnings of listed companies, eased property market concerns, and favorable foreign market conditions.

- Sustaining foreign capital inflows depends on strong economic fundamentals, comprehensive policies, and improved U.S.-China relations.

In early 2023, the Chinese mainland stock market experienced a surge of foreign capital, prompting analysts to consider the factors needed to sustain investor confidence [para. 1]. Data from the Stock Connect program, which facilitates trading between Hong Kong’s and mainland China’s stock exchanges, showed that net overseas investment reached 83 billion yuan ($11.7 billion) in the first five months of the year, nearly doubling the total of the previous year but still falling short of 2021's figures [para. 2].

The influx of foreign investment was attributed to stronger-than-expected profits from listed companies, notably internet giants, and reduced concerns over systemic risks due to China’s prolonged property slump, according to UBS Investment Bank Research's James Wang [para. 3]. Historically, foreign funds have tended to flow into Chinese markets during index rebounds or periods of strong policy support [para. 4]. Recent policy efforts in China have aimed to support the lagging property market, improve capital markets, and tackle other economic challenges, thereby boosting foreign investor confidence [para. 5].

Significant policy measures included a May 17 announcement that removed the national mortgage interest rate floor and reduced some minimum down-payment requirements to support the housing market. Concurrently, the State Council issued the “National Nine Articles” to enhance the quality of listed companies and restore investor confidence in mainland stocks [para. 6]. Additionally, overseas market conditions, such as volatility in U.S. and other Asian stock markets and a stronger U.S. dollar, made Chinese stocks appear more attractive to investors [para. 7][para. 8].

Global mutual funds held only 5.7% of their assets in Chinese stocks by the end of April, a historically low share over the past decade, as reported by Goldman Sachs [para. 9]. The favorable conditions following last year’s market slump made Chinese shares relatively cost-effective, drawing in short-term funds looking to capitalize on low prices [para. 10]. Brendan Ahern of KraneShares noted improving earnings expectations for internet companies and better economic recovery bolstered by policy support as key factors attracting global investors [para. 11].

Despite the earlier momentum, the Stock Connect program saw a slowdown, with net overseas investment in mainland shares dropping to 38.6 billion yuan in the first half of the year as investors reduced their holdings in June [para. 12]. Analysts had grown cautious about the market as early as May [para. 13]. JPMorgan Chase & Co. analysts pointed out that domestic bond yields were at record lows, house prices were anticipated to decline further, and global investors remained hesitant, driven primarily by fundamental factors like nominal growth and corporate earnings [para. 14].

In May, the MSCI China Index rose by approximately 30% from its January low, primarily due to improved sentiment rather than enhanced earnings expectations [para. 15]. For sustained inflows of foreign capital, analysts emphasized the importance of solid economic fundamentals. JPMorgan emphasized the need for comprehensive property rescue plans and stronger domestic demand to foster a positive outlook on Chinese equities [para. 16]. Moreover, Goldman Sachs highlighted that the sustainability of the stock market rally hinges on U.S.-China relations and economic fundamentals [para. 17]. Without significant positive shifts in Sino-U.S. trade tensions and economic recovery, sustained foreign capital inflows remain uncertain, as observed by Ci Weiwei from Western Securities Co. Ltd. [para. 18].

Reporters Qing Na and editor Michael Bellart provided contact details [para. 19].

- March 2024:

- Ci Weiwei, an analyst at Western Securities Co. Ltd., noted that without significant positive changes in U.S.-China relations and economic fundamentals, sustainable return of foreign capital would be questionable.

- As of the end of April 2024:

- Global mutual funds had only 5.7% of their assets invested in Chinese stocks, low by historical standards over the last decade.

- May 8, 2024:

- Brendan Ahern, Chief Investment Officer of KraneShares, wrote an analysis highlighting that global investors are slowly returning and that top-down policies are supporting shareholders.

- May 9, 2024:

- JPMorgan Chase & Co.’s private banking analysts published a report stating that domestic bond yields are at all-time lows and house prices are expected to fall further.

- May 17, 2024:

- A package of policies to aid the housing market was announced, removing the national mortgage interest rate floor and cutting some minimum down-payment requirements.

- May 23, 2024:

- JPMorgan analysts pointed out that the MSCI China Index was up around 30% from its January 2024 low.

- In the first five months of 2024:

- Net overseas investment in the market via the Stock Connect program reached 83 billion yuan, nearly double last year’s total.

- In the first half of 2024:

- Net overseas investment in mainland shares via the Stock Connect slumped to 38.6 billion yuan, indicating that overseas investors slashed their holdings of mainland stocks in June 2024.

- PODCAST

- MOST POPULAR

Sign in with Google

Sign in with Google

Sign in with Facebook

Sign in with Facebook

Sign in with 财新

Sign in with 财新