China’s Manufacturing Returns to Modest Growth, Caixin PMI Shows

Listen to the full version

Activity in China’s manufacturing sector resumed moderate growth in August after a contraction the previous month, according to a Caixin-sponsored survey published Monday.

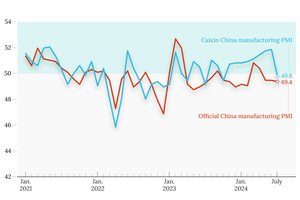

The Caixin China General Manufacturing Purchasing Managers’ Index (PMI), which gives an independent snapshot of the sector, came in at 50.4 in August, up 0.6 points from the previous month. A reading above 50 indicates an expansion in activity, while a number below signals a contraction.

Download our app to receive breaking news alerts and read the news on the go.

Get our weekly free Must-Read newsletter.

- DIGEST HUB

- China's manufacturing PMI rose to 50.4 in August, indicating a return to moderate growth after contraction, though it was the second-lowest level this year.

- Manufacturing output and demand recovered, but exports shrank, input costs and output prices declined, and delivery times worsened.

- Challenges to growth remain due to insufficient domestic demand, uncertainties in external demand, and weak market optimism; policy support is needed.

- 2024:

- China’s government has an ambitious annual GDP growth target of around 5%.

- By the first half of 2024:

- Manufacturing accounted for 27% of China’s GDP.

- Second quarter 2024:

- Chinese economy showed a trend of stabilization.

- July 2024:

- Manufacturing output growth slowed to the weakest pace in nine months.

- By July 2024:

- Demand experienced a decline for the first time in 12 months.

- August 2024:

- Activity in China’s manufacturing sector resumed moderate growth.

- As of August 2024:

- Caixin China General Manufacturing Purchasing Managers’ Index (PMI) came in at 50.4.

- As of August 2024:

- Exports shrank for the first time in eight months.

- As of August 2024:

- The labor market stabilized after an 11-month run of declines.

- As of August 2024:

- Backlogs of work increased for the sixth straight month.

- August 2024:

- Both input costs and output prices declined, with output prices reaching the lowest level in four months.

- August 2024:

- Delivery times lengthened for the third month in a row.

- August 2024:

- Future output expectations improved but remained below the historical average.

- PODCAST

- MOST POPULAR

Sign in with Google

Sign in with Google

Sign in with Facebook

Sign in with Facebook

Sign in with 财新

Sign in with 财新