Chinese Fund Firm’s Recently Resigned Chairman Linked to U.S. President’s Son

Listen to the full version

The recently resigned chairman of Harvest Fund Management Co. Ltd., who is cooperating with authorities in an investigation, has had ties to the U.S., including a connection to U.S. President Joe Biden’s son, Hunter, public information shows.

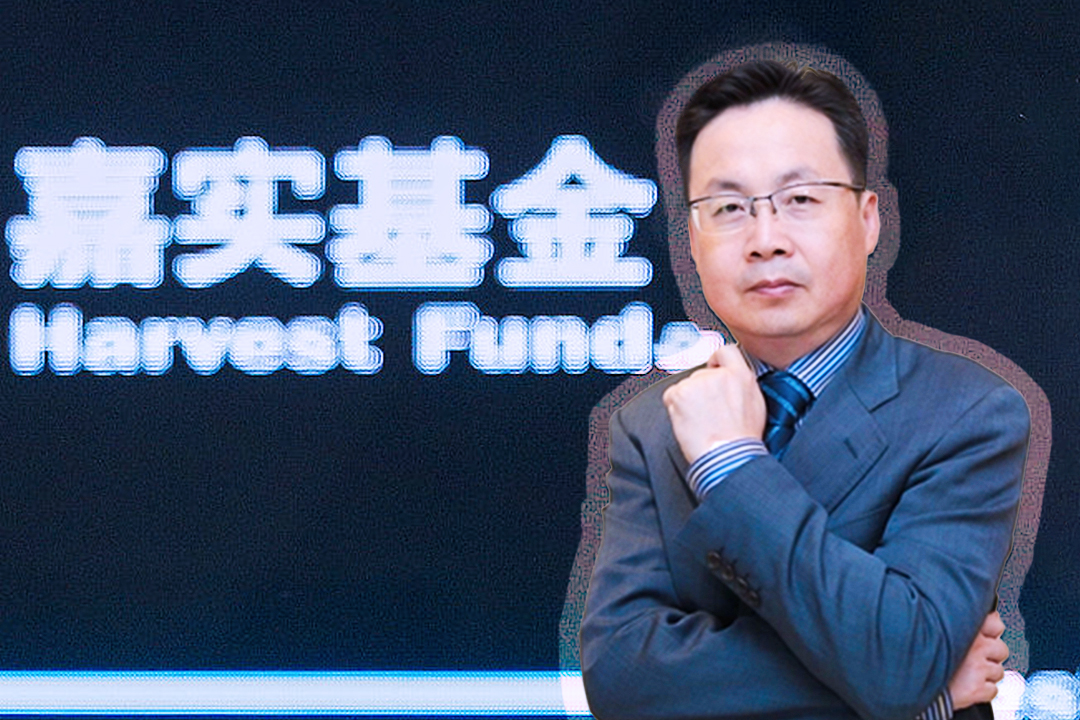

Beijing-based Harvest announced Friday the resignation of Zhao Xuejun, saying that his cooperation with authorities isn’t related to the mutual fund firm’s fund business.

Download our app to receive breaking news alerts and read the news on the go.

Get our weekly free Must-Read newsletter.

- DIGEST HUB

- Zhao Xuejun, recently resigned chairman of Harvest Fund Management, is under investigation, though unrelated to the firm's fund business.

- Zhao has ties to Hunter Biden and served in leadership roles at both Harvest and the State Legislative Leaders Foundation.

- Harvest Fund Management, established in 1999, has assets worth 971.1 billion yuan ($135.4 billion) and Deutsche Bank AG owns a 30% stake.

- Harvest Fund Management Co. Ltd.

- Harvest Fund Management Co. Ltd. was established in 1999 as one of China’s first mutual fund management firms. As of last Friday, it managed assets worth 971.1 billion yuan ($135.4 billion), ranking eighth among Chinese mutual fund companies. Harvest is a Chinese-foreign joint venture, with DWS Investments Singapore Ltd., a Deutsche Bank AG subsidiary, holding a 30% stake.

- Bohai Harvest RST (Shanghai) Equity Investment Fund Management Co. Ltd.

- Bohai Harvest RST (Shanghai) Equity Investment Fund Management Co. Ltd., now BHR Partners, was set up in 2013 by companies including Harvest Fund Management and Skaneateles LLC, Hunter Biden's company. Hunter Biden was a founding board member until April 2020, when his father was running for the presidency. Hunter's lawyer stated he no longer holds any interest in BHR or Skaneateles as of November 2021, though Skaneateles remains a shareholder, according to business records.

- BHR Partners (Shanghai) Equity Investment Fund Management Co. Ltd.

- BHR Partners (Shanghai) Equity Investment Fund Management Co. Ltd. was established in 2013 by several companies, including Harvest and Skaneateles LLC, which is associated with Hunter Biden. Initially named Bohai Harvest RST (Shanghai) Equity Investment Fund Management Co. Ltd., Hunter Biden was a founding board member until April 2020. He no longer holds any interest in BHR or Skaneateles, although Skaneateles remains a shareholder.

- Skaneateles LLC

- Skaneateles LLC is Hunter Biden's company and was one of the founding companies of BHR Partners (Shanghai) Equity Investment Fund Management Co. Ltd. Hunter Biden was a founding board member of BHR until April 2020. While a lawyer for him stated in November 2021 that he "no longer holds any interest, directly or indirectly, in either BHR or Skaneateles," business records show Skaneateles remains a shareholder of BHR.

- DWS Investments Singapore Ltd.

- DWS Investments Singapore Ltd. is a subsidiary of Deutsche Bank AG, holding a 30% stake in Harvest Fund Management Co. Ltd., a leading mutual fund management company in China.

- 2013:

- BHR Partners (Shanghai) Equity Investment Fund Management Co. Ltd. was set up by Harvest and Skaneateles LLC.

- 2014:

- Zhao became a vice president of the State Legislative Leaders Foundation (SLLF) and was in charge of the organization’s Asian operations.

- 2016:

- Zhao gave a speech at Peking University, mentioning his vice-presidency at SLLF.

- April 2020:

- Hunter Biden resigned as a founding board member of BHR Partners.

- November 2021:

- New York Times reported that Hunter Biden no longer holds any interest in BHR or Skaneateles, according to his lawyer.

- March 2024:

- A former business associate of Hunter Biden testified before a U.S. congressional committee that Zhao was a business associate of Hunter Biden.

- Friday, August 9, 2024:

- Harvest announced both the investigation into Zhao Xuejun and Zhao's resignation.

- As of Friday, August 9, 2024:

- Harvest had 971.1 billion yuan ($135.4 billion) in assets under management.

- PODCAST

- MOST POPULAR

Sign in with Google

Sign in with Google

Sign in with Facebook

Sign in with Facebook

Sign in with 财新

Sign in with 财新