Daily Tech Roundup: Apple Feels the Squeeze From Chinese Rivals, Foxconn’s New China HQ

Listen to the full version

Welcome to the Daily Tech Roundup — a briefing of the top technology news making headlines in China and the rest of Asia.

China’s smartphone brands take a bite out of Apple

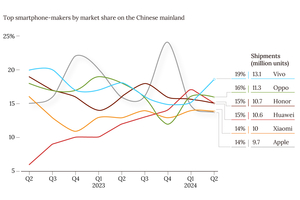

Chinese smartphone-makers’ shipments jumped in the second quarter, squeezing out American rival Apple Inc. as the domestic handset market rebounded.

In the quarter ending June, the top five brands in the Chinese mainland’s smartphone market were all domestic, according to a report by market research firm Canalys on Thursday. The last time local players comprised all of the top five brands by number of units shipped was nearly four years ago, another research firm, IDC, said Friday.

Download our app to receive breaking news alerts and read the news on the go.

Get our weekly free Must-Read newsletter.

- DIGEST HUB

- Chinese smartphone brands dominated the domestic market in Q2 2023, marking their first all-top-five appearance in nearly four years, with shipments growing 10% year-on-year.

- WeRide, a Chinese driverless tech startup, filed for potentially the biggest U.S. IPO by a Chinese firm since Didi, planning to raise up to $500 million.

- Foxconn will build a $138.2 million headquarters in Henan for EVs, and Alibaba backed a $2.8 billion investment in AI startup Baichuan, valuing it at 20 billion yuan.

The Daily Tech Roundup highlights significant technology news from China and broader Asia, featuring updates on smartphone shipments, major IPO filings, AI advancements, corporate expansions, and significant investments. [para. 1]

### China’s Smartphone Market Rebounds

In the second quarter, Chinese smartphone brands dominated the domestic market, surpassing Apple Inc. [para. 2] According to Canalys, the top five brands by shipment volume were all domestic, a scenario that has not occurred in nearly four years, as noted by IDC. This strong local performance was mirrored by a 10% year-on-year growth in China's smartphone market during the quarter, with shipments exceeding 70 million units. The growth was driven by significant discounts and promotions, particularly during the "6.18" shopping event in June. [para. 3][para. 4][para. 5]

### WeRide Files for Major U.S. IPO

Driverless technology startup WeRide Inc. has filed for what could become the largest U.S. IPO by a Chinese firm since Didi Global Inc.’s turbulent listing in 2021. [para. 6] WeRide, incorporated in the Cayman Islands, aims to raise up to $500 million, but the exact number and price range for its American depositary shares remain undisclosed. This IPO occurs amid uncertainties surrounding regulatory risks for Chinese companies listing abroad, especially after the regulatory crackdown that followed Didi’s $4.44 billion IPO. [para. 7][para. 8]

### Zhipu AI Debuts Qingying Video Generator

Zhipu AI, a Beijing-based large language model startup, launched Qingying, an AI-powered video generator aimed at rivaling OpenAI’s Sora. [para. 9] Qingying produces videos up to six seconds long with a resolution of 1440x960 pixels from text or graphic prompts. Users can generate varied video styles, including movies and 3D cartoons, complemented by background music. [para. 10][para. 11]

### Foxconn’s New Headquarters for EV and Battery Manufacturing

Foxconn, known for its iPhone assembly, plans to diversify its business by establishing a new headquarters in Henan province, China, focusing on electric vehicles (EVs) and batteries. [para. 12] The company will invest 1 billion yuan ($138.2 million) in the facility situated in the Zhengdong New District of Zhengzhou. Foxconn hopes to capitalize on its expertise in smart manufacturing and supply chains to expand into new sectors, including EVs, energy storage, digital health, and robotics. [para. 13][para. 14]

### Alibaba Invests in AI Startup Baichuan

Alibaba Group has taken part in a new financing round of 5 billion yuan for the Chinese AI startup Baichuan, marking its third major AI investment of 2024. [para. 15] With this funding, Baichuan is valued at 20 billion yuan, receiving backing from local governments in Beijing, Shanghai, and Shenzhen, alongside major tech firms like Tencent and Xiaomi. Founded in April 2023, Baichuan has released 12 large language models and debuted an AI assistant in May, underscoring its leadership in China’s generative AI space. [para. 16][para. 17]

### Conclusion

These updates underscore the dynamic nature of the Asian technology landscape, characterized by significant market competition, innovative technological advancements, and strategic investments and expansions by leading firms. From the resurgence of domestic smartphone brands to high-stakes IPOs and major corporate shifts towards new sectors, these developments highlight the region’s pivotal role in shaping global tech trends. [para. 1][para. 2][para. 3][para. 4][para. 5][para. 6][para. 7][para. 8][para. 9][para. 10][para. 11][para. 12][para. 13][para. 14][para. 15][para. 16][para. 17]

- Apple Inc

- Apple Inc. experienced a decline in market share in China during the second quarter as shipments from Chinese smartphone brands surged. This marks a significant shift in the domestic handset market, where local players now dominate the top five brands by units shipped.

- WeRide Inc.

- WeRide Inc. is a driverless technology startup that filed for what could be the biggest U.S. IPO by a Chinese company since Didi Global Inc.'s 2021 listing. The company is based in the Cayman Islands and aims to raise up to $500 million. However, it faces legal and operational risks due to its primary operations in mainland China.

- Didi Global Inc.

- Didi Global Inc. is a Chinese ride-share company that had a disastrous IPO in 2021, raising $4.44 billion. Following its listing, Beijing initiated a crackdown on firms with sensitive data selling shares abroad, leading to a significant decline in U.S. listings by China-based companies.

- Zhipu AI

- Zhipu AI, a Beijing-based startup, launched its AI-powered video generator Qingying, capable of creating 1440x960 resolution videos up to six seconds long from text or graphic prompts. Qingying aims to rival OpenAI's Sora in the competitive Chinese market. Users can generate videos in styles like movies and 3D cartoons with background music.

- Foxconn Technology Group

- Foxconn Technology Group, formally known as Hon Hai Precision Industry Co. Ltd., is investing 1 billion yuan ($138.2 million) to establish a new headquarters in Zhengzhou, Henan province, China. The facility will focus on manufacturing electric vehicles (EVs), batteries, digital health, and robotics, aiming to reduce Foxconn's reliance on assembling iPhones. The company plans to leverage its core competencies in smart manufacturing, technologies, and supply chain resources.

- Hon Hai Precision Industry Co. Ltd.

- Hon Hai Precision Industry Co. Ltd., known as Foxconn, is planning to establish a new headquarters in Henan province, China, to produce electric vehicles (EVs) and batteries. The new facility will be located in Zhengzhou's Zhengdong New District. Foxconn's investment aims to leverage its capabilities in smart manufacturing, technologies, and supply chain to diversify from its dependence on assembling iPhones.

- Alibaba Group Holding Ltd.

- Alibaba Group Holding Ltd. participated in a new financing round of 5 billion yuan for Chinese startup Baichuan. This marks Alibaba’s third major AI deal of 2024 as it seeks growth beyond its core business. Baichuan, now valued at 20 billion yuan, is a leader in China’s generative AI space, with investments also from Tencent Holdings Ltd. and Xiaomi Corp.

- Baichuan

- Baichuan is a Chinese startup valued at 20 billion yuan after recent financing, including 5 billion yuan from Alibaba and other investors. Founded in April 2023, the company is a leader in generative AI in China, releasing 12 large language models and debuting an AI assistant in May 2024.

- Tencent Holdings Ltd.

- Tencent Holdings Ltd. is one of the existing investors in Chinese startup Baichuan, which recently received 5 billion yuan in new financing. Tencent joined other investors, including the governments of Beijing, Shanghai, and Shenzhen, as well as Xiaomi Corp. The investment boosts Baichuan's valuation to 20 billion yuan.

- Xiaomi Corp.

- Xiaomi Corp. participated in the recent financing round for Chinese startup Baichuan, which has been valued at 20 billion yuan. This investment is part of Baichuan's growth in the generative AI space, supported by other significant backers like Tencent Holdings Ltd. and the Beijing, Shanghai, and Shenzhen governments.

- By June 2024:

- The top five smartphone brands in the Chinese mainland’s market were all domestic.

- Wednesday, July 24, 2024:

- Foxconn announced plans to establish a new headquarters in Henan province.

- Thursday, July 25, 2024:

- Canalys reported on Chinese smartphone shipments.

- Thursday, July 25, 2024:

- Baichuan valued at 20 billion yuan after new financing, backed by Alibaba among others.

- Friday, July 26, 2024:

- IDC confirmed the top five smartphone brands in the Chinese mainland’s market were all domestic.

- Friday, July 26, 2024:

- WeRide filed for the biggest U.S. IPO by a Chinese company since Didi.

- Friday, July 26, 2024:

- Zhipu AI launched its artificial intelligence-powered video generator Qingying.

- PODCAST

- MOST POPULAR

Sign in with Google

Sign in with Google

Sign in with Facebook

Sign in with Facebook

Sign in with 财新

Sign in with 财新