Four Things to Know About Tianqi Lithium’s Reversal of Fortunes

Listen to the full version

It has been a rough year for Tianqi Lithium Corp. (002466.SZ).

Plunging lithium prices have pushed the Chinese producer of the key battery raw material far deeper into the red, just as an ongoing tussle with the Chilean government has left the payoff from its biggest overseas investment in doubt.

In mid-June, Chile’s securities regulator rejected Tianqi’s request to give shareholders a chance to vote on a deal that would allow Santiago to take greater control of the country’s largest lithium reserve in the Atacama salt flat.

Download our app to receive breaking news alerts and read the news on the go.

Get our weekly free Must-Read newsletter.

- DIGEST HUB

- Tianqi Lithium Corp. faced significant financial trouble due to plummeting lithium prices and heavy debts from earlier aggressive investments, leading to a 48% drop in stock price this year and a 3.9 billion yuan net loss in Q1 2024.

- The Chilean government's move to nationalize lithium assets and the rejection of Tianqi’s request for a shareholder vote on the SQM-Codelco partnership further compounds Tianqi's financial issues.

- Analysts have drastically cut profit estimates for Tianqi, with significant concerns about future profitability and the negative impact of global lithium market dynamics and political risks.

Tianqi Lithium Corp. (002466.SZ) has experienced a challenging year, marked by plummeting lithium prices and an ongoing conflict with the Chilean government over its significant overseas investment. This year, the company's share price has dropped by 48%, closing at 28.73 yuan ($3.95) per share, its lowest since late 2020. Analysts have lowered profit estimates due to concerns about the company's performance and the impact of the SQM-Codelco partnership on its interests in Chile's lithium reserves. In the first quarter of 2024, Tianqi reported a net loss of 3.9 billion yuan, compared to a 4.9 billion yuan profit in the same period last year [para. 1][para. 3][para. 5][para. 6].

The decline in lithium prices only partially explains Tianqi's difficulties. Much of the company's woes can be traced back to two aggressive overseas investments made during the 2010s, which gave it access to some of the world's best lithium reserves but also saddled it with enormous debts. The combination of leveraged investments, an unfavorable business cycle, political risks, and poor term agreements has turned the company’s initial advantages into liabilities [para. 6][para. 7][para. 8].

Tianqi made a significant gamble in 2018 by acquiring a 23.77% stake in Sociedad Quimica y Minera de Chile SA (SQM) for nearly $4.1 billion at a time when electric vehicles' popularity was on the rise. However, political changes in Chile, including a move to nationalize lithium assets, have jeopardized that investment. In May 2023, SQM and Chile's state-owned Codelco agreed to form a joint venture to produce lithium, effectively diluting Tianqi's interest in the business [para. 14][para. 17][para. 19].

Additionally, in 2014, Tianqi's parent company acquired a 51% stake in Australia's Greenbushes, the world's largest hard-rock lithium mine. Both investments were highly leveraged, financed in part by a $3.5 billion syndicated loan, and included compromises such as giving up any right to a seat on SQM’s board [para. 20][para. 21][para. 22][para. 27].

Tianqi's expansion was driven by market opportunities and a desire to scale quickly, yet lacked a seasoned management team to effectively navigate crucial factors such as timing and macroeconomic conditions. The company’s founder noted that the investments were somewhat rushed, coinciding with a slide in lithium prices that slashed profits and increased liabilities, which exceeded 80% in 2019 and 2020. Tianqi’s net losses amounted to nearly 6 billion yuan in 2019, following a profitable year in 2018 [para. 30][para. 33][para. 34].

In July 2021, Tianqi sold half its stake in the Greenbushes mine, a move criticized for undermining the company's competitiveness. The deal’s impact was evidenced when the company reported another net loss due to falling lithium prices and lower investment returns from SQM [para. 38][para. 39]. Analysts have since lowered Tianqi’s 2024 profit forecasts, with some predicting it barely breaking even or experiencing more significant losses [para. 43][para. 44][para. 45].

Tianqi’s plight reflects broader trends affecting the global lithium industry. Falling prices, surplus inventory, and geopolitical risks—especially nationalistic policies in South America aimed at retaining profits from natural resources—pose ongoing challenges. Chinese investors remain wary about the business environment in countries like Chile, further clouding Tianqi’s future prospects [para. 47][para. 49][para. 52].

- Tianqi Lithium Corp.

- Tianqi Lithium Corp. (002466.SZ) is a Chinese lithium producer facing severe financial troubles due to plummeting lithium prices and burdensome debts from aggressive overseas investments. This includes a costly stake in Chile's SQM, now threatened by a nationalization push. Tianqi’s stock has plunged 48% this year amid these issues, compounded by political risks and unfavorable terms in its deals. The company reported a net loss of 3.9 billion yuan for Q1 2024.

- Sociedad Quimica y Minera de Chile SA (SQM)

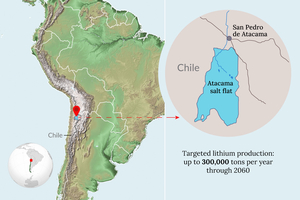

- Sociedad Quimica y Minera de Chile SA (SQM) is a Chilean company involved in lithium production. It has formed a joint venture with state-owned Corporación Nacional del Cobre de Chile (Codelco) to produce refined lithium in the Atacama salt flat from 2025 to 2060. Tianqi Lithium Corp. has a 22.16% stake in SQM, but the new partnership and government's increasing control over lithium resources threaten to dilute Tianqi's profits and influence within the company.

- Corporación Nacional del Cobre de Chile (Codelco)

- Corporación Nacional del Cobre de Chile (Codelco) is a state-owned entity in Chile. It recently formed a joint venture with Sociedad Quimica y Minera de Chile SA (SQM) to produce refined lithium in the Atacama salt flat from 2025 to 2060. This partnership will grant Codelco a 51% stake and allow the Chilean government to receive 70-85% of the venture's operating margin over time.

- Huafu Securities Co. Ltd.

- Huafu Securities Co. Ltd. is a firm that provides financial analysis and forecasting. In the article, they revised their 2024 forecast for Tianqi Lithium Corp. from a 3.3 billion yuan net profit to a 939 million yuan net loss, indicating a significantly more pessimistic outlook for the company.

- Soochow Securities Co. Ltd.

- Soochow Securities Co. Ltd. is a brokerage firm that provides financial services including securities trading, investment consultancy, and asset management. According to an article, researchers at Soochow Securities have significantly reduced their profit estimate for Tianqi Lithium Corp., lowering it to 10 million yuan for 2024, down from 3.57 billion yuan a year earlier.

- CMOC Group Ltd.

- CMOC Group Ltd. (603993.SH) is a leading global metals producer known for its deliberate acquisition strategy and strong financial management. It took an 80% stake in one of the world's largest copper and cobalt mines in the Democratic Republic of Congo through deals in 2016 and 2017. CMOC maintains substantial cash reserves, amassing over $10 billion during an industry downturn in 2015-2016 to ensure it can make future investments while maintaining healthy cash flow.

- Ganfeng Lithium Group Co. Ltd.

- Ganfeng Lithium Group Co. Ltd. (002460.SZ) is a Chinese lithium mining company that reported a first-quarter net loss of 439 million yuan, compared with a 2.4 billion yuan net profit a year earlier. Like Tianqi, Ganfeng has been impacted by the plunging lithium prices and the global market surplus, contributing to its financial struggles.

- December 2021:

- Gabriel Boric elected as President of Chile.

- April 2023:

- Chile’s President Gabriel Boric announced that the state will participate in the entire lithium production cycle in a 'public-private collaboration.'

- May 31, 2024:

- SQM and Codelco announced they had agreed to form a joint venture to produce refined lithium in the Atacama salt flat from 2025 to 2060.

- Mid-June 2024:

- Chile’s securities regulator rejected Tianqi’s request to give shareholders a chance to vote on a deal allowing Santiago greater control of the country's largest lithium reserve.

- June 19, 2024:

- Tianqi filed a request with Chile’s Financial Market Commission (CMF) to require the deal to be approved by a two-thirds majority of voting shareholders.

- June 28, 2024:

- CMF rejected Tianqi’s request, and Tianqi appealed the decision.

- PODCAST

- MOST POPULAR

Sign in with Google

Sign in with Google

Sign in with Facebook

Sign in with Facebook

Sign in with 财新

Sign in with 财新