In Depth: A New Chinese Food and Beverage Wave Hits Southeast Asia

Listen to the full version

Forget kung pao chicken and sweet and sour pork. There’s a new wave of food and beverage chains flowing out of China, and it’s all about Sichuan hot pot, braised chicken rice and pickle fish soup — as well as mainstays like bubble tea.

Chinese food and beverage (F&B) companies have expanded quickly into Southeast Asia, and even into North America and Europe, in the past few years, driven in part by saturation at home. According to Huafu Securities Co. Ltd., nearly 3.19 million new F&B enterprises were registered in China in 2023, a 24.2% increase from the previous year.

Download our app to receive breaking news alerts and read the news on the go.

Get our weekly free Must-Read newsletter.

- DIGEST HUB

- Chinese F&B chains, focusing on Sichuan hot pot and bubble tea, are expanding internationally due to market saturation at home and saw a 24.2% increase in new enterprises in 2023.

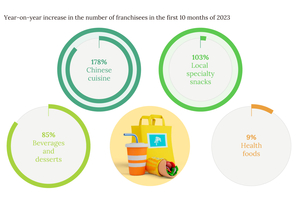

- Franchising is a popular growth strategy, with brands like Mixue and Luckin Coffee establishing strong presences in Southeast Asia and beyond.

- Challenges include supply chain development, localization, and management issues, necessitating adjustments to local tastes and operational models.

A new wave of Chinese food and beverage (F&B) chains, including Sichuan hot pot, braised chicken rice, and pickle fish soup, is making its mark internationally beyond traditional dishes like kung pao chicken and sweet and sour pork [para. 1]. The expansion of Chinese F&B companies into Southeast Asia, North America, and Europe has been driven partly by saturation in the domestic market [para. 2]. In 2023, nearly 3.19 million new F&B enterprises were registered in China, marking a 24.2% increase from the previous year [para. 2]. This rapid growth is evidenced by significant overseas recruitment and operational capacity expansions, with some company payrolls growing over 200% annually for the past three years [para. 3].

However, these ambitious expansion efforts face challenges in building solid supply chains and addressing localization issues [para. 5]. Sichuan hotpot giant Haidilao International Holding Ltd. began its international foray twelve years ago by establishing a presence in Singapore and now has a significant number of overseas outlets [para. 6]. Other brands like Tai Er, Zhangliang Malatang, and Yang’s Braised Chicken Rice have also successfully expanded internationally, showcasing diverse Chinese cuisines [para. 7].

The competitive landscape for small F&B businesses demands high levels of operational efficiency, cost management, and innovation [para. 8]. On the beverage side, Mixue, China’s largest bubble tea chain, opened its first overseas store in Hanoi in 2018 and has since expanded to 11 countries with over 4,000 stores as of September 2023 [para. 9]. Heytea, Shuyi Tealicious, Chabaidao, and Chagee have also expanded internationally, reflecting the broader trend among Chinese beverage brands to tap into global markets [para. 9]. Coffee chain Luckin Coffee, having bounced back from previous scandals, opened its first overseas store in Singapore and has expanded to 37 stores by June 2023 [para. 10].

Franchising is a key strategy for many Chinese F&B brands seeking international footholds; it allows rapid growth and leverages local business acumen [para. 12][para. 13]. Zhangliang Malatang, for example, received significant interest for franchising opportunities, especially from the U.S., Southeast Asia, and Europe, which aided its rapid expansion [para. 15]. Countries like Indonesia, with large populations and favorable cost structures, offer significant business opportunities, reducing the payback period for F&B investments to between six months and a year [para. 16].

Singapore serves as a gateway for many Chinese brands aiming to venture into Western markets, acting as a testing ground for their capabilities and consumer interest [para. 18][para. 19]. Businesses like Luckin Coffee and Chagee have established multiple outlets in Singapore before moving to other regions [para. 19]. Adaptation to local preferences is crucial for success; for instance, post-pandemic market dynamics in regions like Indonesia shape consumer spending habits favorably for Chinese F&B chains [para. 21].

Despite potential, Chinese F&B brands face supply chain hurdles and workforce management challenges in overseas markets [para. 29][para. 30]. Franchised operations aid growth but highlight issues like supply chain immaturity and regulatory discrepancies between China and host countries [para. 31][para. 32]. Localization is imperative to sustain international success, ensuring brands adjust to local market norms without compromising their core strengths [para. 32]. Effective localization strategies include tailored menus and operational adjustments to match local customs and expectations, critical for long-term global success [para. 32][para. 33].

- Haidilao International Holding Ltd.

- Haidilao International Holding Ltd. is a Sichuan hotpot giant that began its international expansion twelve years ago in Singapore. By March this year, its overseas operator, Super Hi International Holding Ltd., managed 119 stores globally, with the majority situated in Southeast Asia. Haidilao operates its own stores overseas rather than franchising, and it has successfully expanded into various international markets.

- Super Hi International Holding Ltd.

- Super Hi International Holding Ltd. is the overseas operator of Haidilao International Holding Ltd., a Sichuan hotpot giant. By March 2023, Super Hi International Holding Ltd. operated 119 stores globally, with the majority located in Southeast Asia. The company's first international expansion began twelve years ago in Singapore.

- Tai Er

- Tai Er serves poached fish with pickled vegetables and has expanded into Singapore, Malaysia, Thailand, Indonesia, and the U.S. Initially succeeding in Singapore in 2021, it expanded rapidly to other regions. In the North American market, Tai Er adapted its service model to suit local customs by removing self-checkout and increasing staff interaction.

- Zhangliang Malatang

- Zhangliang Malatang is a spicy hot pot brand with 63 stores across 15 countries as of last year. The brand has expanded significantly since announcing international franchising opportunities in 2019, with a focus on the U.S. market and rapid growth in Southeast Asia. They created guides for eating malatang in Singapore and are addressing localization and supply chain challenges.

- Yang's Braised Chicken Rice

- Yang's Braised Chicken Rice operates in over 10 countries with more than 100 stores. The company emphasizes high operational efficiency, cost management, and innovation. Its Asia-Pacific headquarters prioritize both domestic brand upgrades and overseas expansion.

- Mixue

- Mixue, China's largest bubble tea chain, expanded to 11 countries with over 4,000 stores by September 2023. The brand opened its first overseas store in Hanoi, Vietnam, in 2018. Mixue has employed franchising for its rapid growth and uses a standardized model to streamline its international operations.

- Heytea

- Heytea has expanded rapidly overseas since 2023, opening stores in London, Melbourne, New York, Kuala Lumpur, and Vancouver. The company primarily employs franchising to expand internationally and relies on Chinese entrepreneurs abroad to manage their outlets. Franchising has allowed Heytea to tap into local knowledge and business acumen to select store locations and run operations effectively.

- Shuyi Tealicious

- Shuyi Tealicious is a Chinese beverage brand that expanded its operations overseas in 2023. It ventured into markets such as Malaysia, Vietnam, Indonesia, and Spain.

- Chabaidao

- Chabaidao, a Chinese bubble tea brand, debuted in Seoul in June as part of its overseas expansion efforts.

- Chagee

- Chagee, an upstart tea brand, returned to Singapore in August 2024, aiming to establish its Asia-Pacific headquarters there. The company plans to expand into five other ASEAN countries over the next five years. Like Luckin Coffee, Chagee self-operates its stores and offers the same products as in China.

- Luckin Coffee Inc

- Luckin Coffee Inc., a Chinese coffee chain, has turned its fortunes around by shifting to a franchising model domestically. It opened its first overseas store in Singapore in March last year and quickly expanded to 37 stores by the end of June this year. The company views Singapore as a mature coffee market and a strategic touchstone for further international expansion.

- 2011:

- Haidilao International Holding Ltd. began its international expansion with an outlet in Singapore’s Clarke Quay.

- 2018:

- Mixue opened its first overseas store in the Vietnamese capital of Hanoi.

- 2019:

- Chagee debuted in Malaysia.

- 2019:

- Zhangliang Malatang announced international franchising opportunities.

- 2021:

- Tai Er's initial success in Singapore.

- By March 2023:

- Super Hi International Holding Ltd., Haidilao’s overseas operator, counted 119 stores globally.

- As of last year:

- Zhangliang Malatang had 63 stores across 15 countries.

- September 2023:

- Mixue had expanded to 11 countries with more than 4,000 stores.

- Late June 2024:

- Luckin Coffee opened 32 self-operated stores in Singapore within a year.

- PODCAST

- MOST POPULAR

Sign in with Google

Sign in with Google

Sign in with Facebook

Sign in with Facebook

Sign in with 财新

Sign in with 财新