In Depth: China’s Booming Nuclear Sector Lobbies for Green Vouchers to Ensure Profits

Listen to the full version

Nuclear power is making an aggressive comeback in China, after a long lull precipitated by the 2011 Fukushima nuclear disaster in neighboring Japan.

The meltdown, which followed a deadly earthquake and a tsunami that knocked out the plant’s power supply, led to mass evacuations and environmental contamination, and sent a chill through the global nuclear energy industry.

Download our app to receive breaking news alerts and read the news on the go.

Get our weekly free Must-Read newsletter.

- DIGEST HUB

- China is resuming aggressive nuclear power expansion after a post-Fukushima pause, with 11 new reactors greenlit in 2023, costing over 200 billion yuan ($28 billion).

- Market reforms pose challenges to the nuclear sector, traditionally benefiting from fixed pricing, as they must now adapt to competitive pricing strategies.

- China's current nuclear capacity is 58.08 GW, aiming for 70 GW by 2025; it may fall short but is expected to be the world leader by 2030.

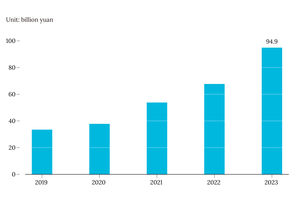

China is aggressively reinstating its nuclear power program after a decade-long lull following the 2011 Fukushima disaster, which caused global hesitancy on nuclear energy. Following the disaster, China drastically reduced new reactor approvals with sporadic permissions in 2012 and 2015, and a complete freeze from 2016 to 2018 [para. 1][para. 2][para. 3]. However, the need to transition away from carbon-heavy energy sources in order to meet environmental targets prompted the Chinese government to fast-track nuclear projects. Recently in August 2024, the State Council approved the construction of 11 new nuclear reactors across five stations in coastal provinces like Jiangsu, Shandong, Guangdong, Zhejiang, and Guangxi, with an estimated total cost exceeding 200 billion yuan ($28 billion) [para. 4][para. 5].

Despite these expansions, China's nuclear sector faces challenges due to incoming power distribution reforms aimed at marketizing electricity, a significant shift from the fixed pricing structure that has historically benefited the sector. These reforms gained traction following the power shortages in 2021 and are expected to be well enacted by the time the new reactors come online [para. 6][para. 7]. China currently operates 56 nuclear reactors with a capacity of 58.08 gigawatts (GW), ranking second globally after the U.S. with 94 reactors. Despite this, nuclear power only accounts for about 5% of China's electricity, significantly lower compared to its share in the global and EU electricity mix [para. 8][para. 9]. China’s plans, as per the 14th Five-Year Plan, are to elevate this capacity to 70 GW by 2025, but current projections by the Global Energy Monitor suggest China might lag slightly behind, reaching around 63 GW by 2025, and 71 GW by 2026, surpassing France's 66 GW [para. 10][para. 11].

Integrating more nuclear power into a newly competitive and market-driven electricity framework presents another layer of complexity. The national electricity trading volume rose by 7.9% year-on-year in 2023, with over 60% of electricity now traded on the market [para. 14]. Specific regions like Guangdong, Jiangsu, Shandong, Guangxi, and Fujian have already initiated nuclear power contracts [para. 15]. For instance, in 2023, China General Nuclear Power Corp. (CGN) sold 57.3% of its produced energy on the market, up from 33.5% in 2020 [para. 17].

Nuclear power companies, long accustomed to price stability, face challenges in adapting to the fluctuating market rates. Since 2013, the on-grid price for new nuclear plants has been around 0.43 yuan per kWh, modifiable based on local thermal power costs [para. 24]. Entering this competitive market means navigating cost structures that differ from cheaper sources like coal, and the operational limits of adjusting power outputs to match demand can incur additional costs. For instance, ancillary services for nuclear units in Shandong can reach tens of millions of yuan monthly [para. 27].

Moreover, high safety and construction costs further complicate the financial landscape of nuclear power. Generation IV reactors, while safer, currently cost around 0.6 yuan/kWh, more than double that of third-generation units at 0.25 yuan/kWh [para. 29]. The price stability of nuclear power is crucial, especially if coal prices remain above 800 yuan per ton, allowing nuclear power companies to sustain profitability [para. 31].

Politically, there is a push to integrate nuclear energy into the green certificates system, incentivizing its use. Including nuclear power in this system would align with China's broader environmental goals, such as those set for the non-ferrous metals sector, where 30% of aluminum production will be powered by renewable energy by 2030 [para. 35][para. 36]. Nuclear power's stable and low-carbon output is vital for specific users like electrolytic aluminum factories, giving them longer-term supply agreements at steady prices. Guangxi, a significant aluminum producer, is set to further nuclear power and aluminum sector synergies [para. 39].

- China General Nuclear Power Corp. (CGN)

- China General Nuclear Power Corp. (CGN) operates 27 reactors and reported that it sold 57.3% of the energy it produced on the market in 2023. This is a significant increase from 33.5% in 2020, indicating CGN’s growing participation in a competitive electricity market.

- State Power Investment Corp. Ltd. (SPIC)

- State Power Investment Corp. Ltd. (SPIC) is a central state-owned enterprise in China that operates nuclear reactors. The article mentions that SPIC runs two units of the Haiyang Nuclear Power Plant in Shandong province, which has included nuclear power in its electricity spot market since November. This marks part of the broader efforts to integrate nuclear power into competitive market frameworks.

- China Southern Power Grid Co. Ltd.

- China Southern Power Grid Co. Ltd. is a company mentioned in the article as having an insider who commented on nuclear power's entry into the market. The insider highlighted that nuclear power companies seek stability and are not keen on market fluctuations, preferring fixed pricing.

- China National Nuclear Corp. (CNNC)

- China National Nuclear Corp. (CNNC) is one of the four central state-owned enterprises operating nuclear power plants in China. CNNC's involvement includes active promotion of bundling nuclear power with green certificates, aiming to enhance marketability and integrate nuclear energy into China's green power system.

- China Huaneng Group Co. Ltd. (CHNG)

- China Huaneng Group Co. Ltd. (CHNG) is one of four central state-owned enterprises operating nuclear power plants in China. It has benefited from fixed pricing since 2013, selling electricity on-grid for new plants at 0.43 yuan per kilowatt-hour, with local adjustments. The company faces challenges with marketization due to fluctuating prices and the high costs of maintaining grid stability.

- 2011:

- Fukushima nuclear disaster

- 2012:

- China curbed new reactor approvals

- 2015:

- China approved only a handful of new reactors

- 2016-2018:

- Three-year freeze on new reactor approvals in China

- 2021:

- China's 14th Five-Year Plan set a target of 70 GW installed nuclear power capacity by 2025

- 2021:

- Power crunch chaos in China

- November 2022:

- China developed a plan to decarbonize the non-ferrous metals industry and promote clean energy alternatives

- 2023:

- National electricity market trading volume increased 7.9% year-on-year

- 2023:

- China General Nuclear Power Corp. sold 57.3% of its energy on the market

- November 2023:

- Northern China’s Shandong province included nuclear power in its electricity spot market

- Aug. 19, 2024:

- The State Council greenlighted the construction of 11 new nuclear power reactors

- PODCAST

- MOST POPULAR

Sign in with Google

Sign in with Google

Sign in with Facebook

Sign in with Facebook

Sign in with 财新

Sign in with 财新